London Market Outlook

News | 27 January 2019

Central London investment volume totaled £18.25bn in 2018, comfortably ahead of the 5 year average of £16.6 bn. with overseas investors once again continuing to be extremely active in the market accounting for circa 79 per cent of all central London real estate acquisitions. London’s’ safe haven status, long occupational leases, the strong UK legal structure and attractive exchange rates continued to be some of the main reasons why such investors continued to purchase central London properties.

Some of the key points from 2018 were:

- Overseas investors continued to dominate the market accounting for circa 79% of acquisitions in central London.

- Trophy investments were once again highly sought after with investors willing to pay strong prices.

- Long dated income opportunities continued to be the best performing type of asset with prime yields remaining resilient.

- UK investors are still active in central London. M&G have just paid £115m for the former Financial Times’ London headquarters.

- 2018 saw the return of some of the UK’s largest developers to the central London market. LandSec acquired 25 Lavington Street (a mixed used development site on the Southbank) and British Land acquired the Paddington Triangle site (an office development in Paddington). These acquisitions emphasise developer confidence in London as a location and the occupier market in the medium to long term future.

Central London Investment Outlook 2019

Investment Market

- We anticipate continued value in central London offices. The value will be underpinned by the strong fundamentals of restricted supply of quality new space and sustained strong occupier demand.

- Assets which are supported by good infrastructure and transportation links, which boast attractive amenities and can continue to adapt to evolving tenant requirements will continue to deliver good returns to investors. Land Sec and CPPIB have asset managed NOVA in a manner that should shield potential purchasers from the negative effects of cyclical slowdowns and also be in a better position to weather Brexit risks.

- After the 2016 referendum there was a short, sharp drop in pricing across the capital markets, however core assets recovered quickly. It would not be unreasonable to predict that this will happen again post the Brexit date on March 29.

- We anticipate fund managers continuing to increase their global allocations to real estate. If fund managers brought allocations up to 10 per cent, it could result in another US$700 billion flowing into real estate markets worldwide. This would undoubtedly lead to new waves of investment in central London property.

- The weakening of the pound will continue to create an environment of good value for overseas investors.

- Long-dated income assets with strong covenants will remain in demand and provide shelter from the uncertainty in the UK economic market.

- The continued demand for London office investments will offer investors liquidity in the ability to buy and sell assets.

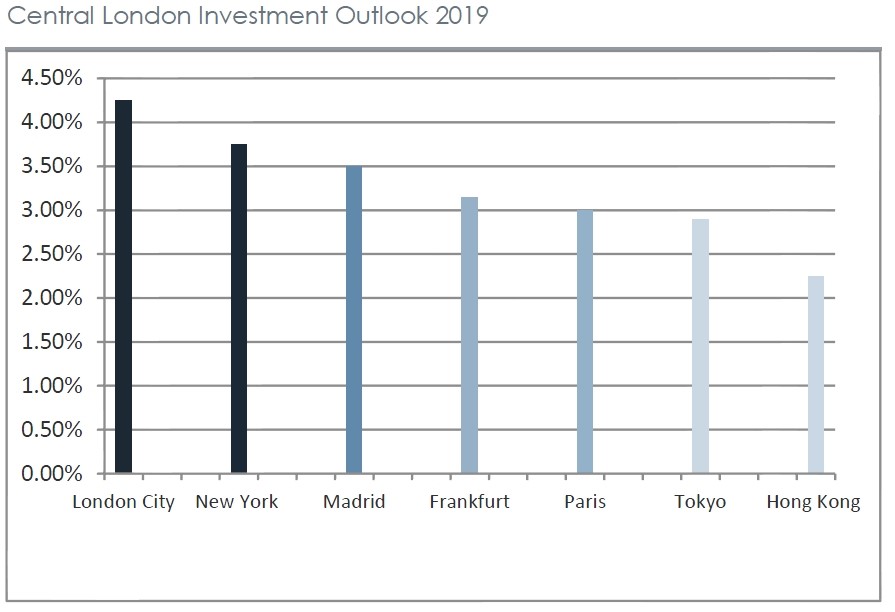

- A key driver for continued global demand for London offices will be the attractive relative pricing on offer across the capital. London assets will remain good value on a global basis with prime yields running at 4.25%.

Occupational Market

- The occupational market in central London continues to perform well. Despite overbearing Brexit noise, London had the best year for take-up since 2001 at 12.8m sqft (9.5m sqft 2017) with the City having recorded 7.9m sqft (5.4m sqft 2017).

- Much of the tenant demand is structural – through lease breaks and expiries. This has led to a significant increase in buildings being pre-let.

- Pre-lets made up 28% of all West End take-up for 2018, boosted by the deal to Facebook at King’s Cross Central (611,000 sqft). Other significant pre-letting deals included Apple taking 470,000 sqft at Battersea Power Station, Penguin Publishers taking 84,000 sqft in Vauxhall, Sony taking 77,000 sqft in the Brunel Building in Paddington and finally We Work taking 150,000 sqft at 5 Merchant Square, Paddington.

- It is not just large multinational companies who have been taking pre-lets in central London. Many smaller occupiers with lease expiries or break options in the next 1-4 years have been taking pre-lets as they look to secure their future real estate requirements now given the future under supply. Moving forward the constrain on future supply of Grade A space is likely to result in competitive situations between would be occupiers which will result in decreasing rent-free periods across central London.

Development Market

- The total development pipeline for Grade A office in the West End stands at 5.4 million sqft of which 51% has been pre-let.

- Looking at the figures more closely in 2019 we expect 2.7 million sqft of Grade A office space to be completed in the West End of which 36% has already been pre-let.

- It should be noted that the majority of larger West End developments are in Fringe locations, including NW1, Battersea and Hammersmith.

Brexit Outlook

In the event of a hard Brexit we anticipate the West End is sufficiently more insulated from the potential negative effects compared to the City market. GVA’s Research team have tracked fifteen banks which have publicly stated that they will look to move a proportion of their workforce to other European cities post Brexit. Banks are looking to relocate some staff to other countries, so they can continue to benefit from the legal and regulatory frameworks required to do business with the European Union. Given most of these financial occupiers are located in the City there will be potential vacancy issues for owners of these assets.

The West End, and particularly Victoria, has been successful in attracting a variety of business sectors to the area which has created a diversified working environment which undoubtedly benefits the owners of commercial buildings.

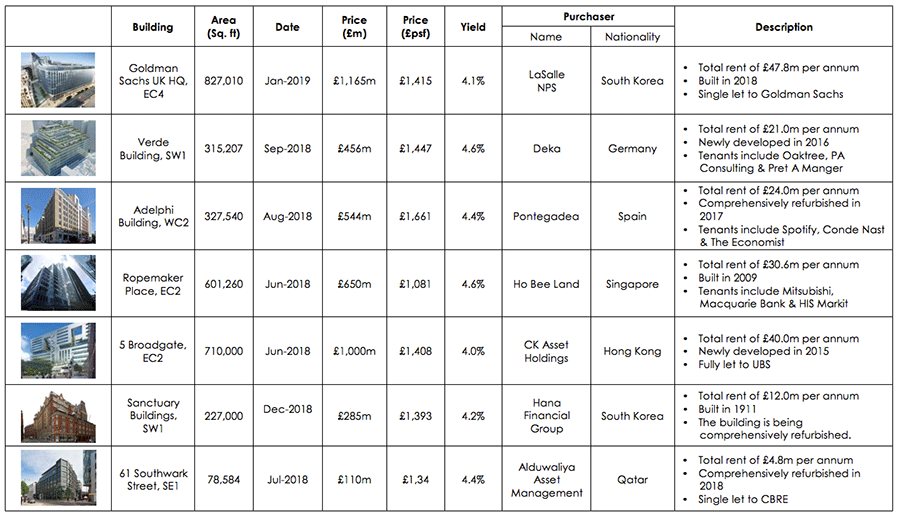

Key Central London Investment transactions (2018)

As we have discussed in the review of 2018 demand for trophy investments has remained robust with foreign investors continuing to pay strong prices for best in class assets. The table below outlines some of these key deals: